“In 2025, our Group celebrates its 50th anniversary, marking five decades of market presence in Malaysia. This milestone reaffirms our commitment to delivering high-quality, value-for-money products to our customers and creating sustainable value for our shareholders whose support will remain vital in the years ahead."

This MD&A shares the operating and financial performance of the business of Beshom Holdings Berhad (“BESHOM” or “Company”) and its group of subsidiaries (“BESHOM Group” or “Group”) for the financial year ended 30 April 2025 (“FY2025”). The MD&A discusses the Group’s performance followed by detailed discussion of each segment’s performance and activities.

The information provided is in a summary form and does not purport to be complete as of the date of this Annual Report. Where appropriate, information is also provided in relation to activities that have occurred after FY2025. The MD&A is not intended to constitute and should not be relied upon as advice to shareholders or potential investors and does not consider the investment objectives, financial situation or needs of any investors. These should be considered with or without professional advice, when deciding if an investment is appropriate.

The MD&A may contain forward-looking statements or opinions including statements regarding our intent, beliefs or current expectations on the market conditions, and results of operations and financial conditions with respect to BESHOM Group’s business. Such statements are usually predictive in nature, may be based on assumptions made or subject to unknown risks and uncertainties, which may cause actual results to differ materially from the results ultimately achieved. Readers are therefore cautioned and advised not to place undue reliance on any forward-looking statements.

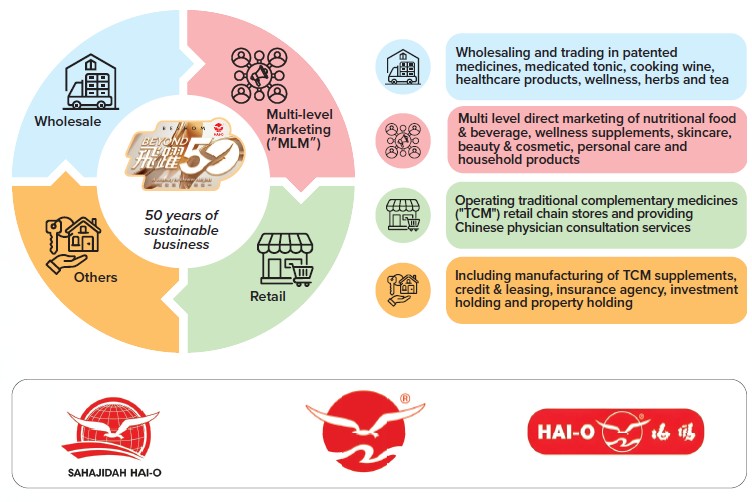

For the FY2025, BESHOM Group’s business operations remained largely unchanged where our businesses segregated into 3 major business segments in Multi-Level Marketing (“MLM”), Wholesale and Retail. There are varying levels of integration between these segments, including sales and shared distributions services. Other businesses operated by the Group include manufacturing, credit & leasing, investment and property holding. Our “Hai-O” brand has built a deep connection with consumers as a trusted traditional health food supplier for 50 years. In 2025, our Group celebrates its 50th anniversary, marking five decades of market presence in Malaysia. This milestone reaffirms our commitment to delivering high-quality, value-for-money products to our customers and creating sustainable value to our shareholders whose support will remain vital in the years ahead.

FY2025 continued to be affected by elevated uncertainty amid heightened geopolitical tensions. The prolonged armed conflicts between Russia and Ukraine, as well as the Israel-Hamas war, which triggered the ongoing Red Sea crisis, further exacerbated the situation. These global developments, coupled with domestic policy adjustments such as higher utility tariff rates, Sales and Services Tax (“SST”) amendments, and the implementation of targeted subsidies, have contributed to inflationary pressures, economic uncertainty, and subdued consumer sentiment. In this volatile macroeconomic and geopolitical environment, BESHOM remained especially vigilant in managing risks. Throughout the year, we managed price pressures and stay operationally agile to sustain sales and profitability. By leveraging our strong business fundamentals and exercising cost discipline and risk management, we navigated through these challenging times and concluded the financial year profitably.

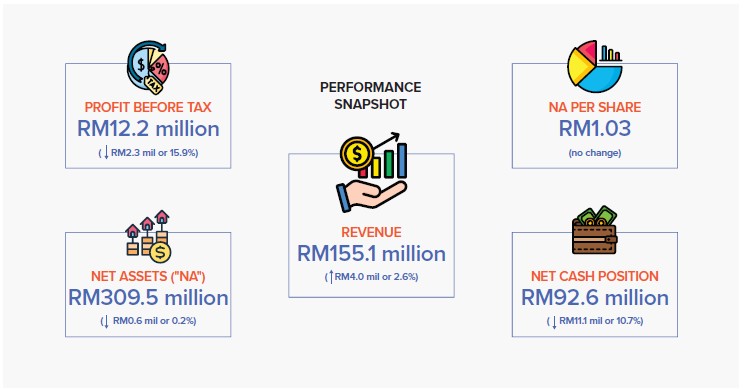

The geopolitical and macroeconomic headwinds continued to affect the businesses of the Group. Sector-specific challenges such as inflation and subdued consumer spending weighed on the Group’s top-line performance and overall profits. Despite an uncertain macroeconomic backdrop, BESHOM delivered resilient fiancial peformance for FY2025. All business segments recorded an improvement in revenue bringing the total revenue of the Group to RM155.1 million (FY2024: RM151.1 million), an increase by approximately 2.6% as compared to the previous financial year. Our business segments in MLM, Wholesale and Retail each charted a modest increase in revenue of between 2% to 3.0%. Despite an improvement in revenue, our businesses were impacted by rising costs. The gross profit margin for FY2025 moderated from 41.5% in FY2024 to 40.5% in FY2025.

The impact of cost pressures extended beyond direct input costs, affecting other indiect operating expenses, particularly within the Retail segment. Although we proactively implemented various cost management initiatives and practiced cost discipline across all business levels, our businesses were affected by higher import cost and the increase in personnel and rental costs. We recorded profit before taxation (“PBT”) of RM12.2 million for FY2025 which represents a reduction of 15.9% against previous year PBT of RM14.5 million. Profit of the year attributable to the owners’ of the Company is RM8.5 million for FY2025 which reduced by 21.9% as compared to last financial year.

Despite a modest results achieved for FY2025, we maintained a prudence approach to capital management. We have strong liquidity where our total current assets is RM189.7 million against a total current liabilities of RM26.6 million as at 30 April 2025. The consolidated net assets (NA) of the Company or the equity attributable to owners of the Company as at 30 April 2025 was at RM309.5 million (FY2024: RM310.1 million), supported by total assets of RM355.2 million (FY2024: RM349.7 million) and total liabilities of RM34.3 million (FY2024: RM27.7 million). The major component of the Group assets is in the form of cash and cash equivalents and other investments of financial assets in unit trusts amounted to RM92.6 million as at 30 April 2025 (FY2024: RM103.7 million), which is aligned to our business activities which are mostly transacted on a cash basis.

Borrowings remained low at RM4.9 million as compared to our assets and equity despite a term loan to finance a purchase of a shop lot for FY2025. The credit facilities available to the Group are to meet short-term working capital and trade purposes. We continue to enjoy significant financial flexibility as and when we need to tap on the debt market for any potential investment opportunity.

We have a 50-year track record as stewards of shareholders’ capital. Over the past 5 decades, our Group grows progressively while striving our best to improve return on equity. This is clearly demonstrated by our high dividend payout ratio for the past years. Despite the industry wide challenges, for FY2025, BESHOM declared an interim dividend of 1.5 sen and proposed a final and special dividend of 1.5 sen and 1.0 sen respectively totalling 4 sen for the FY2025, representing more than 140% payout ratio. As long as our business and financial fundamentals permit, BESHOM Group remains committed to balance growth ambitions and provide sustainable returns to shareholders.

The Group’s overall financial performance for FY2025 reflects our persistent efforts to deliver returns to our shareholders amid a tepid economic backdrop and cautious consumer spending. The rising cost of living continued to weigh on consumers, while global geopolitical uncertainties caused ripple effects on both business and financial performance.

Multi-Level Marketing Segment

For FY2025, the MLM segment contributed about 35% and 36% of the total revenue and PBT respectively generated by the Group. Sahajidah Hai-O Marketing Sdn. Bhd. (“SHOM”) operates the businesses of multi-level direct marketing of nutritional food & beverages, wellness, skincare, beauty & cosmetic, personal care and household products. The products under the MLM segment are distributed to members via our wide online and offline distribution networks through 29 physical stores in the form of branches, stockists and sales points across Peninsular and East Malaysia, and 1 branch in Brunei. The MLM segment has also set-up a Members Portal dedicated to members serving as a platform for sales and a central hub for up-to-date information on the company, products, promotional activities, and compliance updates.

In FY2025, the MLM segment recorded a total revenue of RM53.5 million (FY2024: RM52.0 million) and PBT of RM4.4 million (FY2024:RM1.5 million). This sale performance was driven by various strategies implemented throughout the financial year. Along with the improvement in revenue, the MLM segment PBT improved by more than 190% as compared to FY2024, which was primarily contributed by the improved gross margin and ongoing cost management initiatives.

Recognising that subdued consumer spending is likely to persist in FY2025, the MLM segment has implemented various strategic initiatives, including talent capability management, effective marketing campaigns, expansion of network, product mix enhancement and cost optimisation.

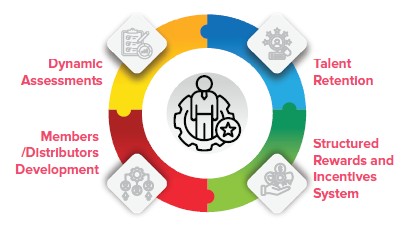

Talent Capability Management

The financial and operational performance of the MLM segment for FY2025 is the result of the hard work from our management team and our respectable team of approximately 39,000 distributors as at end of FY2025, based across Malaysia. We remain humbled by the team’s dedication to keep pace with the exceptional tough market. In FY2025 our investment in distributors focused on trainings initiatives aimed at retaining, developing, and enriching our distributors’ network, following dynamic assessments carried out during the year. Acknowledging that our membership force is the backbone of the business, we remain committed to enhancing our distributors’ capabilities as the MLM segment continues to grow in scale and maturity.

Dynamic assessments – The MLM segment started the year with a series of comprehensive assessments to evaluate the skills and quality of leaders and to address areas for improvement aimed at strengthening team relationships and effectiveness. The dynamic assessments were conducted in the form of workshops, offline and online trainings, capitalising on SHOM’s internal resources and the expertise of CDMs who possess a deep understanding of our business culture, while also managing training costs. These workshops incorporated coaching, mentorship, and training activities aimed at fostering leadership development. The dynamic assessments were instrumental in evaluating leadership effectiveness and sales performance across our networks.

These assessments enabled us to identify teams that met or exceeded their targets, as well as those that faced challenges. The findings highlighted specific areas for improvement, including refining leadership styles and addressing motivational needs. This allowed us to tailor our support more effectively to help distributors overcome obstacles and drive stronger sales performance moving forward. In addition to harnessing internal capabilities, we also collaborated with external professionals, including certified trainers and subject matter experts, to conduct specialised workshops and symposiums throughout the year. These sessions enriched our training ecosystem by offering fresh insights, expert guidance, and holistic development opportunities. This combination of internal leadership and external expertise helped ensure our distributor network remained agile, well-equipped, and futureready in a rapidly evolving market.

Structured rewards and incentives system – Alongside the dynamic assessments, we continued to enhance the MLM segment’s reward and incentive systems to maintain market competitiveness, aiming to retain and motivate distributors to pursue sales proactively. We introduced Founder's Legacy Diamond Award 2025 for Diamond level rank and Million Dollar Achiever Board Award 2025 for highest ranking distributors to foster performance and group success. The Founder’s Legacy Diamond Award 2025 focused on empowering our second-line leaders i.e. the Diamond Sales Managers (DSM) and Double Diamond Managers (DDM) to stimulate market growth and accelerate their development. This campaign served as a strategic pathway to groom and elevate the distributors towards achieving our highest leadership ranking, the Crown Diamond Manager (CDM), ensuring leadership continuity and long-term business sustainability.

The MLM segment continued to adopt travel incentive programs to drive sales, and bonus travel points were accorded for packages for the individual groups and leaders respectively. For travel incentives targets and packages specifically designed for special purposes, the teams successfully achieved their goals and earned incentive trips to Hanoi, Bali and Tokyo during FY2025.

Talent retention – For FY2025, we achieved a total membership base of 39,000, which comprised 11,600 new members. This achievement was partly supported by the attractive membership fee of only RM10, making it more accessible for new and returning members. To further enhance value to our members, members were also given exclusive privileges to purchase selected food and beverage (F&B), wellness, beauty, skincare, and personal care products at attractive prices through our purchase-with-purchase (PWP) program — a move that encouraged product trial and experience. In addition, to create a positive first impression for new joiners, we streamlined the membership onboarding process, particularly by making the registration procedures more welcoming during events, roadshows, exhibitions and ground activation activities.

Members / Distributors development – As the years before, members / distributors development remained an on-going effort for our team, covering topics involving products knowledge, up-to-date ethics and compliance practices, and skill set training. For effectiveness of the development program, we appointed dedicated managers to review and enhance training structures, segregating the training programs into 2 main categories: basic and leadership. As part of our continuous effort to strengthen product knowledge and sales competency, we conducted a series of 360 Thera Body Shaping Consultant (BSC) Workshops across Central, Northern, East Coast and East Malaysia. Handson tools such as mannequins and testing sets were used to enhance learning and allow real-time product experience. The workshops also served as a platform to promote the 360 Thera Starter Package, featuring the complete product series. In addition to these workshops, we also run weekly 360 Thera Insights Zoominars to continuously upskill our distributors. These sessions covered topics from the product knowledge to leadership development and business success stories, aimed at strengthening distributor’s knowledge, and to promote motivation and engagement.

While distributors development program usually focuses on enhancing the capabilities of the existing members, it also helped in recruiting high quality distributors. This was achieved through our Business Opportunities Programs at stockist and branches that would sharpen existing members acumen in business opportunities while attracting high-quality prospective members to join our MLM networks during product introduction workshops and promotional activities.

Effective marketing campaigns

In FY2025, our marketing activities were executed through nationwide initiatives designed to enhance brand visibility, support distributor engagement, and increase consumer outreach. Participation in key events such as Jom Heboh, the International Islamic Trade & Tourism Expo, and Absolut Bazaar Raya provided platforms to showcase our products to a wider group of audiences. In addition, workshops and themed programs—including Beauty Day, BSC sessions, and the Infinence Skin Series were carried out to strengthen product understanding and customer interaction while building brand affinity and drive product experience. The MLM marketing campaigns planned for the year were complemented by tactical promotions including Women’s Day Flash Sales, the B-XTRA 5.0 Revamp Campaign, and the Awesome Raya Campaign.

Expansion of network

One of the key growth opportunities for the MLM segment lies in expanding our global presence. Over time, supported by our localisation strategy, we endeavour to increase our business contribution from emerging markets. Expansion of international footprint was done through participation in exhibitions held locally and abroad, these includes participation in 2 Brunei Consumer Fairs and MIHAS (“Malaysia International Halal Showcase”) Exhibition. Through the market intelligence collected during these fairs, we successfully expanded our reach to Pakistan and Philippines. We will continue to develop more products with a local identity to cater for overseas markets.

During FY2025, we have successfully expanded our payment network to include the Buy Now Pay Later option through partnership with Atome. Currently, only a few big-ticket items such as the 360 Thera products, AiryVentz, Bio Velocity Sleep Mate and Bio-Evolve come with the Atome instalment payment option. This strategic expansion of payment option has gained traction among the members with more than 800 transactions recorded with sales value of approximately RM1.0 mil transacted via this payment option. We will consider to expand the payment options to more products in the future.

Enhancement of Product Mix

Enhancement of product mix and development was driven by 2 primary objectives — to increase product visibility and to reignite consumer interest in our existing products through innovative upgrades. A total of 11 new stock keeping units (SKU) were introduced during the year, including Thera Socks, 360 Pro-Shake Protein Drink, Nurich Garlic Enteric Coated Tablet and SHOM Peanut Bar Crunch.

In the skincare & cosmetic range of products, several new SKUs were launched under the brands Cozuma and Infinence, nbsuch as Cozuma LushVelvet Lipstick, True Matte Blush Stick, Shape Shifter Contour Stick, Cozuma Natural Skin Tint and the Infinence Radiance Ritual Collection — comprising Deep Hydration Elixir, Aqua Repair Masque, and Radiance Renew Essence. These introductions served both as replacements and extensions to our existing range of cosmetics and skincare series, aligning with our strategy to offer a more complete and functional routine. Notably, the enhancement of the Infinence skincare lineup now enables us to present a comprehensive basic skincare regime to consumers, capturing purchases for the entire basic skincare routine and further strengthening our competitive edge in the skincare category.

Cost Optimisation

The reopening of economies post-COVID-19 crisis saw a recovery in demand, resulting in significant inflationary pressures globally and locally. Although the MLM segment closed the financial year with marginal increase in revenue for FY2025, the scale of improvement in profitability in the MLM segment was more encouraging. While price adjustment for 5 products has helped to improve profitability, nonetheless, the better-than-expected profit level achieved by the MLM segment is primarily contributed by the continuing cost management initiatives undertaken during the year. Cost optimisation efforts were undertaken at all levels operationally, including reduction in personnel cost, improvement in inventory and logistics management, and product cost control through reduction in packaging cost and sourcing for suppliers which offer lower cost of supply. In terms of cost rationalisation from marketing and promotion activities, cost savings were achieved through sharing of costs with business partners for events and exhibitions.

The reduction in personnel cost is the most significant savings achieved by the MLM segment where employees are repurposed to take on different functions within the Group. Concurrently, the initiatives for inventory management and logistics management saw positive impacts through reducing stock holding and maintaining a healthy stock balance. Inventory management also benefited us to avoid unexpected rise in logistics expenses through better order planning. As we had experienced a substantial increase in transportation cost in the past during peak seasons, we worked on advance planning for promotional activities and systemised delivery schedule to reduce costly air freight especially for shipments to East Malaysia. We also made free delivery adjustments for eligibility in term of minimum orders and order dates, where we continue to support our distributors to share delivery charges with delivery fees capped at RM10 for qualifying purchases made after the 26th of each month, eliminating unconditional free delivery incentive during the year.

Wholesale Segment

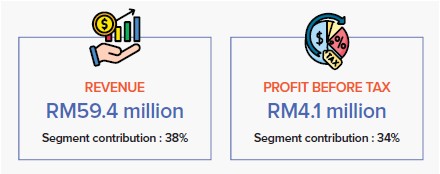

It has been a challenging year for the Wholesale segment. The Wholesale segment contributed about 38% and 34% of the total Group’s revenue and PBT respectively for FY2025.

The Wholesale segment focuses on wholesaling and trading in Chinese medicated tonic and cooking wine, healthcare & nutrition products, general & value herbs, tea & others. For FY2025, the Wholesale segment recorded revenue of RM59.4 million (FY2024: RM58.3 million) and a PBT of RM4.1 million (FY2024: RM8.5 million). Despite the Wholesale segment managed to maintain the revenue level as recorded in the prior financial year, the segment PBT dropped by approximately 51.8%. The results of the Wholesale segment were primarily affected by changes in sales mix and higher costs incurred for import purchases and marketing & branding activities.

The Wholesale segment navigated the evolving market terrain and shifting consumer spending patterns during the financial year with strong commitment. Strategic plans were implemented to drive growth and address ongoing challenges, particularly the rising operating costs and margin squeeze from higher cost of import purchases and changes in product mix. During the year, several factors have contributed to the performance setback under the Wholesale segment, including the drop in sale contribution from the duty-free distribution channel and the lower sales recorded for higher margin products such as medicated tonic and vintage tea. Along with the Group’s 50th Anniversary celebration, the Wholesale segment incurred higher advertising and promotional expenses in FY2025 to support branding activities and customers appreciation events.

The strategies implemented by the Wholesale segment can be grouped into 3 main components, i.e. strategy to drive revenue growth, cost optimisation and entrenched digital adoption. Among the strategies implemented, focus was largely on driving revenue growth where various activities including reinforcing brand visibility through sales events, products focus and development, and network expansion that were undertaken throughout the year.

Revenue growth initiatives

Reinforcement of brand visibility

One of our main approaches to revenue growth is organising sales events throughout the year to reinforce brand visibility. Over 15 events were held during the year, varying in scale and format to meet different objectives. 2 major events took place at the event venue in Genting Highlands, namely the Pagoda Festive Night and the Hai-O Appreciation Night. These are customer engagement events to strengthen communication and brand awareness in preparation for future expansion of product portfolio. For the Hai-O Appreciation Night, we cooperated with business partners of medicated tonics to foster co-brand cooperation and to promote cross selling opportunities. We are confident that these events will extend customer recognition of our products and brands, creating positive associations and perceptions of the brands’ quality and overall experience.

Smaller scale activities with deeper social ties were also organised, such as on-ground roadshows and exhibitions which were held in collaboration with events organised by business partners. These included the Miss Asia and Mr Asia Competition 2024, the 10th International Conference on Traditional Complementary Medicines at National Institute of Health, the 21st Anniversary Celebration of Klang Youzhi Club as well as an annual dinner held by Tan & Pantai Klang Association in Klang, Selangor.

Besides, ticket-based events were organised as platforms for product experiences. 3 such events were held during the year, allowing customers to enjoy their food paired with a variety of Japanese whiskies. The customers could also buy or place orders for the whiskies they enjoyed during the events.

Product focus and development

Product focus and development was actively pursued as a key component of the revenue growth strategy. We started this action plan by identifying our top 40 products to track and monitor its product movements and stock levels. 10 market surveys were conducted to seek feedback on market trends, pricing and product range. Following these market surveys, we rebranded and re-packaged some products including the Lingzhi Chiew, Yang Sheng Chiew, Wincarnis, Hua Diao, Osami and 5 Inno Reno house brand products.

In term of product development, our focus was on the development of fast-moving consumer goods (FMCG) which targeted on health food products such as the Kinds Welgrains-- Hericium Erinaceus, Iron Yam powder; Chinese Yam-Coix Seed-Euryale Ferox Seed powder; Five Black Soybean Milk powder, and Esenz Fruit Essence (Red Goji Berry and Black Goji Berry). Complementing our health food products, we also rolled out various health beverages including the Kinds Premix Cham and Ice Lemon Tea, Yu Yuan Tang Monk Fruit & Chrysanthemum, Misai Kucing Burdock Tea and Jiagulan Ginseng Tea.

Market expansion through resources integration

In addition to promotional activities, and product enhancement, the Wholesale segment had reassessed internal processes to promote revenue growth. This initiative was achieved through resource integration among subsidiaries within the Group such as product development with our manufacturing arm - SG Global Biotech Sdn. Bhd. and joint product promotion campaign with our retail operator, Hai-O Raya Bhd.. These initiatives yielded positive impact, especially on our hamper sales where we achieved better hamper forecast to minimise stock variance and product returns. As a result, together with Hai-O Raya Bhd., we achieved an encouraging sale increase for Chinese New Year (“CNY”) hamper sale of RM1.8 million, representing an increase by 50% as compared to the previous financial year. With proactive strategic plans in place, the main subsidiary under the Wholesale segment – Hai-O Enterprise Bhd. also successfully expanded its customer base to more than 50 new customers which included a significant sales contribution for a newly introduced wellness products of over RM9.0 million in FY2025.

Entrenched digital adoption

Recognising the secular shift toward digitalisation in business operations, resources were allocated to further entrench digital adoption within the Wholesale segment’s business and operational processes. This involves developing social media strategies, creating engaging content, managing online branding visibility, and deepening customers adoption. Promotional videos were uploaded on a regular basis on our official website and other social media platforms to create continuous engagement with customers. Various festive promotions, online exclusive free gift campaigns, and contest activities were featured across our multiple online channels. Key Opinion Leaders (KOLs) were engaged to synchronise with these activities to amplify their impact and drive business growth.

We have started to adopt QR codes on our product packaging in stages, where QR codes have been incorporated for new product packaging and will be added to our existing products packaging progressively to bridge the gap between offline and online marketing efforts and to provide relevant product information to our customers. Our warehouse system using barcode system were being implemented in full swing during the year. This new system will enhance stock management including traceability and minimise stock variance, shorten processing time and improve logistics planning. To facilitate staff’s familiarity of this new warehouse system, we developed a structured training plan after assessing their training needs. We provide ongoing support for our warehouse and logistic staff including gathering feedback for continuous improvement.

Cost optimisation

The action plans for cost optimisation were largely leveraging on digital adoption under the Wholesale segment. With our upgraded SAP ordering system, 99% of our sales are now performed through the SAP ordering portal, minimising paperwork and reducing human resources for paperwork processing. The online ordering portal streamlines order management, and improves efficiency in term of accuracy, hence saving time and resources. Through the SAP ordering system, we also minimise the use of paper ordering forms and hard copy invoices. We have moved towards utilising e-catalogue more regularly instead of printed catalogue to provide products information to our customers. Our ordering tablets are updated monthly to reflect new product launching and provide up-to-date pricing information, expected stock availability, and detailed product information. In addition, the Group reorganised its resources with the upgraded warehouse management system, which improves inventory control to optimise storage utilisation. As a result, excess storage space was freed up and subsequently rented out, generating additional rental income for the Group.

Retail Segment

The Retail segment contributed approximately 23% of the total Group’s revenue but recorded a segmental loss for FY2025. The retail business of the Group is operated under Hai-O Raya Bhd. through its 56 retail chain stores and franchises in major states across Malaysia. Our brick-and-mortar stores are primarily located in Klang Valley (43%), followed by Southern Region (29%) and Northern Region (21%). We also have 1 retail store in East Coast and 3 physical stores in East Malaysia. During the financial year, we added 2 retail stores in Klang Valley and Southern Region. Customers can access our retail portfolio through a wide range of business networks including official website and 3rd party platforms.

The Retail segment recorded a segment revenue of RM35.5 million (FY2024: RM34.7 million), which represents an approximately 2.3% improvement. However, due to higher operating costs, the Retail segment posted a loss of RM0.4 million as compared to a profit before tax of RM0.5 million in the past financial year. The higher operating costs were attributable to an increase in personnel expenses, particularly employees’ overtime expenses following the implementation of the higher minimum wage during the year and in line with the general increase in wage levels across the retail industry. Additionally, profitability of retail segment was further affected by rental costs which had increased by approximately 5% as compared to previous financial year and the higher sales commission charged by 3rd party marketplace such Shopee and Lazada. Higher advertising and promotion expenses were incurred for the CNY Sale campaigns, but in return we posted good sale records for our CNY hampers.

Since the COVID-19 crisis, the Retail segment has experienced prolonged changes that have greatly altered conventional buying patterns and created new consumer behaviours. These shifts have had a wide range of impacts on lifestyles and accelerated the adoption of digital technologies that support the new normal. The role of physical stores is anticipated to evolve through integration with the online purchasing process, as the trend toward a seamless merging of online and offline models continues. The Retail segment was also impacted by economic factors with subdued consumer spending and rising cost of operations in many areas, from salaries to rental, transportation to product costs. All of which have adversely impacted the profitability of the Retail segment. Although the Retail segment posted a loss for the financial year under review, we are confident that we can turnaround the situation with pre-emptive cost management measures in the future.

In response to the challenging business environment, the Retail segment has implemented the following strategic initiatives:

Advertising and promotion – As part of the efforts to increase foot traffic in our retail stores, we focused on offering a series of promotions and sales campaigns aimed for short-term win and building medium-term momentum. We identified 3 outlets in Teluk Intan, Batu Pahat and Kuantan to participate in the in-store carnivals and roadshows which could be implemented quickly and yield immediate results. The Retail segment not only met the sale performance set but doubled the sales target during these in-store carnivals and roadshows. 5 key promotion campaigns were carried out to increase or sustain footfall to our physical retail stores. These included the Cordyceps Promotion, Member Privilege Sale, Stock Clearance Sale, Year End Sale and CNY Sale. Among these promotional campaigns, the CNY Sale Campaign was carried out with the support of a 3rd party branding consultant, through which a series of promotional activities and events were rolled out 2 months ahead leading up to CNY. As part of the campaign, we participated in roadshows at various prime locations, including TRX Shopping Mall, One Utama Shopping Mall, Urban Fresh @ Setia City Mall, Gama Supermarket in Penang and Sutera Mall in Johor. Cross-segment collaboration with the Wholesale segment intensified the sales drive, and contributed to an increase in CNY hamper sales by the retail segment. Hai-O Raya Bhd. recorded approximately 12% increase in CNY hamper sales to RM3.3 million or more than 13,000 units in FY2025.

We remain committed to putting our customers first and have made steady progress over the years to serve them better. The Hai-O Friendship loyalty programme continues to strengthen, with an increase of 15% growth in members for FY2025. This was the outcome of 2 strategic initiatives, the members’ referral program and exclusive members events with business alliances and partners. We began harnessing our customer data collected through our loyalty programme, to refine our product assortment and revamp our house brands and digital strategies.

E-commerce growth has been a multisector trend for several years, especially in the retail industry, and its growth trajectory has continued despite the reopening of the economy following the COVID-19 pandemic. Today, online shopping has become seamlessly embedded in people’s daily lives supporting a push toward faster, ondemand access to goods and services. We continue to leverage on online platforms to build brand awareness, engage with audiences, and drive business results. We believe by strengthening our digital marketing efforts, optimising our online presence, and fostering customer engagement, we can further boost footfall to our retail stores. For FY2025, we aired more than 120 videos, motion graphic contents and short Reels through our official websites and official e-stores and 3rd party platforms. Our active presence through 3rd party marketplace such as Lazada and Shopee was underpinned by sales growth, with more than 1,500 transactions contributing to an increase of approximately RM700,000 sales generated from e-commerce platforms.

Product – Rebranding and brand refresh initiatives were strategically undertaken to revitalise our existing brand’s identity, aiming to modernise the image and feel while preserving the fundamental product values associated with each brand. As part of our rebranding efforts, we redesigned and repackaged a few shortlisted signature products such as the Hai-O Yen Min Chew and Zan Almond Walnut Cereal Powders during the year. The rebranding exercises involves refining visual elements, colour palette, typography, as well as adjusting messaging to better resonate with the current market trend.

From the product expansion front, we increased our product offerings by adding 2 new products to the market, i.e. the Diabetea and Tian Xian Ye. These products are entirely new product lines, with the potential to be developed into specialised range of products to meet specific customer needs in the future.

The introduction of these 2 products took a cue from the market trend that more customers are willing to spend on products which address health issue such as diabetes. These products are supplements that may be beneficial and formulated to support better health management and mitigate health risks. We received encouraging market response of these 2 products. On a combined basis, these 2 products recorded nearly RM1 million in sales for the FY2025 since their introduction.

Value added services – Complementing the rolled out of Tian Xian Ye, we organised 5 online health talks and 1 physical session, aimed at sharing the complexities and insights of various health conditions while promoting how Tian Xian Ye may supplement patients who are undergoing medical treatment. To make our TCM consultation services more accessible to our customers, we added 2 retail outlets with TCM Practitioner services under our belt. Customers can now access our TCM services at our retail outlets in Alam Damai and Johor Bahru, bringing the total number of outlets offering these services to 9 outlets. In addition, we also organised free TCM consultation campaigns and health screening services for customers during the opening of the Puchong outlet and at the events held by our business partners, such as the campaign held by Paramount Property at Berkeley Uptown.

These are retail initiatives going beyond the standard offerings and providing additional value to our valued customers. These services are intended to make our core products more attractive, without any cost to our customers.

People – Learning and development was also a key focus during the year with the introduction of Retail Sales Kit for some of the signature products of the Retail segment, including MingZhu Bai Feng Wan, Cordyceps Capsules, Zhen G Health Tonic and Honbo Series of Products. Our sales kits are collection of materials that contained among others, product ingredients, benefits of products, and how well the products align with a customer's specific needs, preferences and circumstances. The sale kits were created to help our outlets’ personnel to effectively communicate with potential customers, address their needs, and close sales. It is a comprehensive package designed to help our staff to present a consistent message and showcase the benefits of our products.

To motivate and reward our sales teams to achieve specific goals and improve sales performance for our house brand products, Hai-O Raya Bhd. established a new house brand incentives framework to align individual efforts with overall company objectives to drive sales for our high margin house brand products. During the year, we continued our practice of conducting 2 essential training sessions -- Basic Occupational First Aid and Workplace Safety and Health Awareness to facilitate fun engagement between employees and at the same time, promote on-the-job safety awareness.

Other Operating Activities

The Group’s remaining 4% of the total revenue for FY2025 was contributed by the Group’s other operating activities in investment in properties and manufacturing of traditional Chinese medicines and food supplements. Other operating activities recorded a total revenue of RM6.7 million (FY2024: RM6.1 million) and PBT of RM4.1 million (FY2024: RM4.0 million) which represent an increase of 9.8% and 2.5% respectively. The increase was largely due to higher rental income received from our investment properties for the financial year with the performance of the manufacturing activities stayed largely unchanged as compared to the prior financial year.

The Government’s continued focus to optimise expenditure through subsidy rationalisation is an important step in strengthening Malaysia’s fiscal position. Beyond fiscal discipline, initiatives to strengthen industrial policy and climate resilience underscore Malaysia’s ability to continue reforming and reinventing itself and will further lift Malaysia’s future growth potential.

Looking ahead, the global economic and financial environment is subject to considerable uncertainties. These mainly reflect unfolding geopolitical developments surrounding both trade and non-trade restrictions. As a small and open economy, Malaysia is not insulated from these global developments.

In 2025, like many other economies, the Malaysian economy is expected to face challenges arising from global developments. This is against a backdrop of uncertainties surrounding tariffs and other policies from major economies, as well as geopolitical conflicts. Our resilient domestic demand, however, will serve as an important buffer against these external shocks.

(Source: Bank Negara Malaysia Annual Report 2024)

Since the announcement of Malaysia’s 2025 GDP growth forecast in Bank Negara Malaysia’s Economic Monetary Review in March 2025, the global economic landscape has changed considerably. The global growth outlook is affected by shifting trade policies and uncertainties surrounding tariff developments, as well as geopolitical tensions. As a small open economy, Malaysia‘s growth prospects will be shaped by these developments. It is to Malaysia’s advantage that our economy is facing these external headwinds from a position of strength. The latest indicators, including advanced estimates for the second quarter growth, continue to point towards sustained strength in economic activity. Domestic demand has been resilient and will continue to support growth going forward. Favourable labour market conditions, particularly in domestic-oriented sectors, and policy measures will continue to underpin private consumption. Meanwhile, expansion in investment activity will be sustained by progress in multi-year infrastructure projects, continued high realisation of approved investments and catalytic initiatives under the national development plans.

The Malaysian economy remains on a strong footing and is projected to expand between 4% and 4.8% in 2025. Headline inflation is expected to average between 1.5% – 2.3% in 2025 amid moderate demand and cost conditions.

(Source: Press Statement by Bank Negara Malaysia dated 24 July 2025 titled “Malaysia's economy remains on a strong footing and is projected to grow between 4%–4.8% in 2025”)

We navigated FY2025 with satisfactory performance given the challenging macroeconomic backdrop and subdued retail environment. We remain confident in our ability to drive sustainable growth and deliver long term shareholder returns in the years ahead. Tapping into our 50-year market presence and branding strength, we are confident that we will continue to drive sales growth.

In the year ahead, cost management will be a forefront objective to improve profitability as we recognise that cost management is essential for financial stability and overall organisational success. Ongoing negotiations with business partners and product suppliers are already in place to share the costs of advertising and promotional campaigns, while simultaneously increasing cross-selling opportunities for our products. We will drive a more transparent and collaborative approach in negotiations with suppliers to achieve better pricing outcomes and enhance margins across our businesses. On product development, the focus will be on product extension to the existing product lines for deeper entrenchment in the already established market that we built, and to bring new products to the market to meet customer needs and to stay competitive and adapt to changing market demands.

In terms of network expansion, our plan is to optimise our existing infrastructure, by adding new components, and leveraging technology to improve reach, and responsiveness. We plan to scale up distribution of more products with business partners such as convenient chain stores and plan network expansion to increase brand visibility. Internally, we are at an advance stage of conducting some final details to initiate entrepreneurship project to provide career building opportunities for graduates and youth, which include mentorship and practical tips for starting a selfemployed business. As our MLM distributors, sales team and retail staff are the key figures to drive sales growth, we will continue to review and refine various incentive plans to motivate the sales force and enhance productivity, along with the phase based career advancement program for our retail employees.

As we look ahead, we recognise that challenging economic conditions are likely to persist in the near term. The Group is cognisant of the uncertainties caused by the US trade tariffs and its potential impact on the broader economy. In response, we will drive greater efficiency across our business to reset our cost base to a more sustainable level, while remain vigilant in managing our businesses and operations.

I would like to express my appreciation to our shareholders, our valued business partners, and to a wider community for your continued support. Most of all, my thanks go to our dedicated team of employees, who are key to the performance we made for FY2025.

To my fellow members of the Board, thank you for your continued guidance and support.

Tan Keng Kang

Group Managing Director