As we celebrate BESHOM Group's 50th anniversary in 2025, our commitment endures: “delivering sustainable growth and long-term value for generations"

Dear Shareholders,

For 50 years, the success of our Group is accredited to a trusted household name, known for delivering high quality and value for money products to homes across the country. Beshom Holdings Berhad (“BESHOM” or “Company”) and its subsidiaries (“BESHOM Group” or “Group”) is the bearer of the well-known brand “Hai-O”, and is recognised for bringing long-term value to our stakeholders. As we celebrate BESHOM Group's 50th anniversary in 2025, our commitment endures: “delivering sustainable growth and long-term value for generations".

It is my pleasure to present our Annual Report for the financial year ended 30 April 2025 (“FY2025”) on behalf of my fellow team of Directors and to provide you with an overview of the Group’s performance for the past financial year. In recent years, we have witnessed a series of economic disruptions, from rising interest rates and geopolitical uncertainties to the most recent tariffs shocks, all of which resulted in challenging trading conditions. Throughout 2024/2025, market conditions remained mixed. While central banks began shifting toward interest rate cuts in response to the overall global economic slowdown, global growth remained uneven, and geopolitical uncertainty continued to be a reality we navigated daily. Despite these challenges, our Group’s objective held firm - delivering sustainable value to our shareholders and the Group continued to record a profit for FY2025.

Domestically, several policy reforms were rolled out by the Government in 2024/2025. These included higher water tariff rates, adjustments to the Sales and Services Tax and the implementation of targeted subsidies for diesel. It has been a challenging year for BESHOM Group and for many businesses in Malaysia especially in the retail sector, as recessionary like economic conditions creating a tough operating environment amid rising inflationary pressures. Lower consumer and business confidence impacted consumer spending and intensified competitive pricing pressure. Despite resilient top-line performance, the Group's profit for FY2025 saw a modest decline, as adjustments to the increased cost base required more time to take full effect.

The financial performance of FY2025 was flat as compared to the financial year ended 30 April 2024 (“FY2024”). The Group’s revenue increased marginally by RM4.0 million at RM155.1 million (FY2024: RM151.1 million) but recorded a profit before tax of RM12.2 million (FY2024: RM14.5 million), representing a drop of 15.7%. In addition to higher operating cost, the Group’s profitability was also affected by the higher cost of sales, which impacted the gross profit of the Group. Gross profit margin decreased by 1% from 41.5% in FY2024 to 40.5% in FY2025. The higher effective tax rate for FY2025 further impacted the profit recorded for the year from RM10.9 million in FY2024 to RM8.3 million in FY2025. The lower effective tax rate in FY2024 was primarily due to over provision in the prior year.

Generally, the Group’s major business segments in multi-level marketing (“MLM”), Wholesale and Retail contributed to the marginal increase in the Group’s revenue for FY2025. However, in terms of profitability, Wholesale and Retail segments were affected by changes in product mix and high operating costs respectively. MLM segment was able to withstand profit pressures through proactive cost management initiatives.

Please refer to the section “Management Discussion and Analysis by our Group Managing Director” (“MD&A”) for the summary of operations, activities, detailed financial performance of the Group’s major business segments. To gain a broader contextual appreciation of our business, the MD&A should be read together with the Sustainability Statement 2025 and Corporate Governance Statement as enclosed in this Annual Report.

In terms of balance sheet strength, the equity attributable to equity holders of the parent as at 30 April 2025 was at RM309.5 million (FY2024: RM310.1 million), which isequivalent to a net assets (“NA”) per share of RM1.03 (FY2024: RM1.03). The NA of the Group was supported by total assets at RM355.2 million (FY2024: RM349.7 million), with total liabilities at RM34.3 million for FY2025 (FY2024: RM27.7 million). The shareholders’ equity of the Group has remained largely unchanged since financial year ended 2023 as BESHOM distributed most of the profits earned for the last 3 years in the form of cash dividend during the respective financial years after taking into account the Group’s working capital requirements.

In FY2025, the Group has leveraged on bank borrowings to finance a purchase of a shop lot for the Retail segment. Liquidity remained ample for FY2025 with cash and cash equivalents, and other investments of financial assets in unit trusts amounted to RM92.6 million as at 30 April 2025 (FY2024: RM103.7 million). Although there is a slight decrease in cash held as at 30 April 2025, the Board of Directors (“Board”) is of the view that the cash position of the Group remains adequate to capture new opportunities while sustaining the operations of the Group’s business.

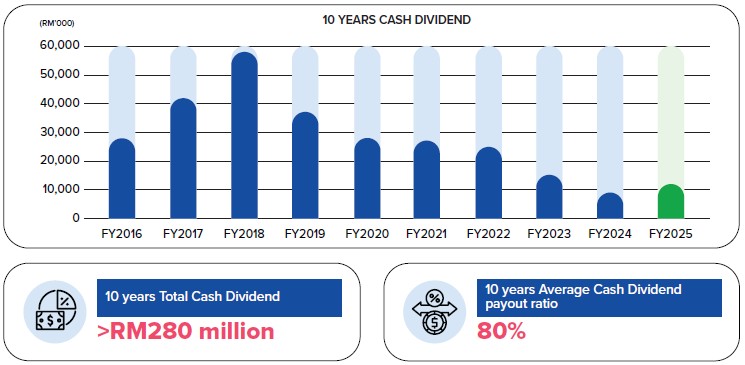

We remain committed to maintaining financial strength and flexibility but at the same time seek to return excess reserves to shareholders. The Company’s dividend policy of distributing dividends with a payout ratio of not less than 50% of the Group’s profit after taxation serves as a guiding reminder for the Group to achieve profitability for sustainable returns to shareholders. While navigating through this time of uncertainty, the Board continued to support dividend declaration and payment after careful assessment of capital sufficiency and cashflow required for operations.

For FY2025, a single tier interim dividend of 1.5 sen per share amounting to RM4,497,196 was declared. The first single tier interim dividend was paid on 17 March 2025. Together with the proposed final single tier dividend of 1.5 sen per share and a special single tier dividend of 1.0 sen per share to be approved by our shareholders at the forthcoming Annual General Meeting (“AGM”), a total dividend of 4 sen was declared for FY2025, which is higher than the dividend declared for FY2024 of 3 sen. The special single tier dividend of 1.0 sen per share was proposed by the Board in celebration of BESHOM 50th Anniversary in 2025 to thank our shareholders for your loyalty and continuous support to the Group. The total dividends of 4 sen for FY2025 represents a dividend payout ratio of more than 140%.

By embracing a culture of learning and adaptation, we strive to implement meaningful and impactful changes. In alignment with our strategic and capital allocation priorities, we continued to simplify the way we work to strengthen the discipline of cost optimisation. We aim to drive greater efficiency across our business to reset our cost base to a more sustainable level, while continuing to invest in our future growth engines, such as product expansion and widen product distribution networks effectively.

Statistically, the Malaysian economy registered commendable growth in 2024, along with moderate inflation. Despite challenges from the global macroeconomic environment, Malaysia’s economy performed well in 2024. The economy recorded a stronger growth, expanding by 5.1% (2023: 3.6%) on the back of robust domestic demand with strong investments, as well as a rebound in exports. Domestic inflation moderated in 2024 against a backdrop of easing global cost conditions and the absence of excessive demand pressures. Both headline and core inflation averaged 1.8% for the year (2023: 2.5% and 3% respectively). (Source: Bank Negara Malaysia (“BNM”) Annual Report 2024) Nonetheless, despite the improved economic backdrop, the industry in which we operate continued to face persistent challenges from factors including softening demand trends and cost pressures.

Malaysia's economy remains on a strong footing and is projected to grow between 4%–4.8% in 2025. Domestic demand has been resilient and will continue to support growth going forward. Favourable labour market conditions, particularly in domestic-oriented sectors, and policy measures will continue to underpin private consumption. Headline inflation is projected to remain moderate, averaging between 1.5% and 2.3% in 2025. Inflationary pressure from global commodity prices is expected to remain limited, contributing to moderate domestic cost conditions. (Source: Press Statement by BNM dated 24 July 2025 titled “Malaysia's economy remains on a strong footing and is projected to grow between 4% – 4.8% in 2025”)

As we look ahead, we know that challenging economic conditions will persist in the near term. Staying ahead means being decisive — strengthening our product offerings, expanding distribution platforms, deepening partnerships, and doubling down on areas where we have a clear edge, while maintaining a rigorous approach to risk management amid heightened uncertainty. We are cognisant of the headwinds currently facing the business including impact of the expansion of SST, which led to some upward price pressures for certain categories of consumer goods and services and the continued softness in consumer spending. We will remain disciplined in our approach and will make changes as appropriate, to navigate these headwinds.

Broadly, to boost sales in the Wholesale and Retail Segments, the Group is reviewing and assessing the effectiveness of the current sales incentive scheme to motivate sales personnel and outlet supervisors. On-going efforts will be focused on product development for all the 3 business segments with the aim to expand product offerings and formulating a more effective product mix that complements sales across all channels through closer collaboration, interaction and sharing of customer insights.

Advertising and marketing which is an essential part of our business will be undertaken in a more structured manner with greater communication between business segments to achieve the desired outcomes while maintaining cost efficiency. As the bottom line of the Group is highly correlated to cost, cost management will remain a key focus for the next financial year. Our management team will closely monitor this area to ensure that we remain both proactive and responsive in maximising the deployment of our resources.

The Board and management are working at pace to implement various strategic business plans aims to enhance performance supported by strong collaboration and commitments at all levels. We are pleased to be building on strong foundations which we believe this will further strengthen resilience across all our business segments. Our journey has brought us a long way from where we began, and I am confident that with the right values and above all, the right team of people, we are well positioned for the future.

The Board and its committees, together with the senior management team, play a key role in delivering long-term returns to our shareholders. The effective execution of our strategy depends on high quality deliberations around the boardroom table, with active participation and meaningful contributions from all Directors.

On behalf of the Board, I would like to express our gratitude to Mr. Soon Eng Sing, who stepped down as an Independent Non-Executive Director with effect from 1 December 2024 after serving the Group for a term of 9 years, in line with the Board Charter. Along with Mr. Soon’s resignation, he relinquished his roles as the Chairman of the Audit Committee and Remuneration Committee and as a member of Nominating Committee. The Board now comprises 6 Directors, the majority (66.7%) of whom are Independent Non-Executive Directors who play crucial role in corporate governance in providing objective oversight and ensuring transparency and accountability.

Sustainability remains at top of our business agenda and we are collaborating closely with our stakeholders and setting sustainability targets across our business segments. I invite our shareholders to refer to the Sustainability Statement 2025 as part of this Annual Report for the Group’s integrated sustainability and climate-related disclosures.

On behalf of the Board of Directors, we would like to recognise the hard work and commitment of our colleagues, who remain committed to supporting our business segments. I would also like to thank our customers, suppliers, and all our partners for their ongoing support throughout the year. Finally, a special word of thanks to our shareholders, as I know many of you have shown great loyalty to the Group for an extended period — not just during the past 12 months.

Thank you.

Ng Chek Yong

Chairman