In an environment of internal and external uncertainties, receiving cash dividends above deposit rates from companies with stable earnings looks increasingly attractive. The housing downturn in the US and a lax lending regime exacerbated by financial products had led to the US subprime crisis and the ensuing credit crunch.

Much has been talked about the US housing crisis but let us look at some numbers to gauge the potential impact on US consumer spending. US homeowners’ equity (market value of home minus mortgage debt) fell to US$9.65 trillion (RM30.4 trillion) at the end of 2007.

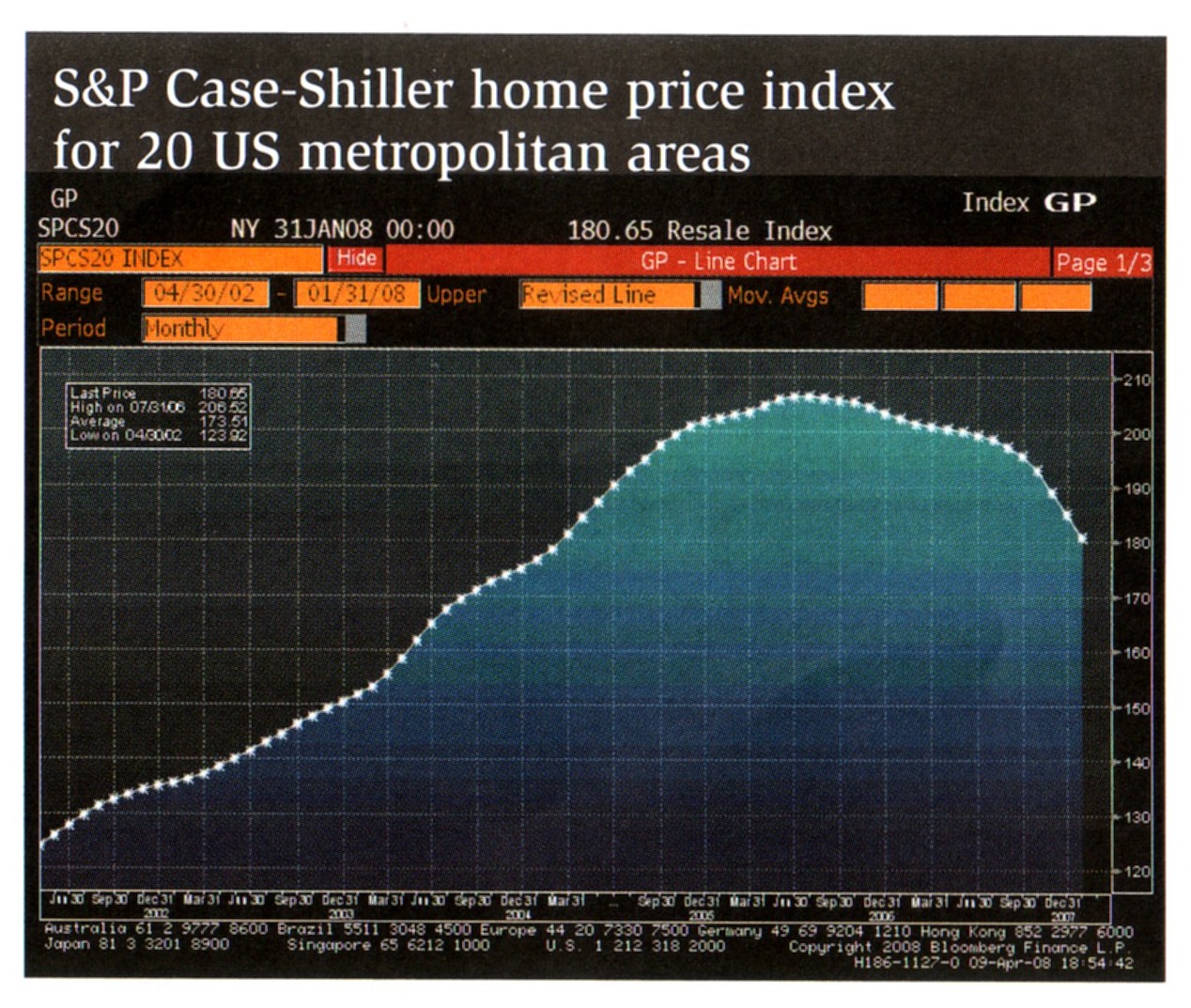

Homeowners’ equity as a percentage of market value fell to 47.9% at the end of 2007, the first year it was below 50% since records were kept in 1945. The market value of homes stood at US$20.1 trillion at the end of 2007. Home prices declined by 2.8% in 2007 and with the inventory of unsold homes at 10 months, home prices will continue to decline. Home prices in 20 US metropolitan areas fell by 10.7% in January 2008 from a year ago (see chart).

Some investment banks are forecasting a 10% to 15% decline in home prices in 2008. A 12.5% decline in home prices will wipe out US$2.5 trillion from US homeowners’ equity, reducing it to US$7.15 billion. Such a large decline in perceived wealth, representing 26% of homeowners’ equity and 18% of US GDP, is likely to curb consumer spending, which represents 70% of US GDP.

Hence, it would appear that an impending US recession and an unfolding housing crisis in the UK and Europe are likely to slow global growth and prolong the banking crisis.

On the domestic front, post-election uncertainties and a review of contracts by opposition-led state governments are likely to slow the implementation of some major government-sponsored projects. Internal bickering within the ruling coalition and efforts by the opposition to woo MPs to cross over have created an uncertain political climate that is not conducive to private-sector investment.

Change is often painful but hopefully, if sane minds prevail, will lead to more openness, transparency and accountability plus a political landscape that expunges the excesses of racial politics. The creation of an independent judiciary is key to ensuring credibility and fairness, which will encourage investments.

A more populist stance by a weakened government can only mean a surge in subsidies. Rice, trading at record high prices, has been added to a long list of goods like petrol and diesel where subsidised domestic prices are significantly below international market prices. The pain to consumers is merely delayed. Either prices will have to be hiked to check an unsustainable budget deficit or new taxes will have to be imposed.

In the current scenario, earning high dividends from shares with limited downside becomes attractive. High dividend yields, especially if they are perceived to be sustainable, are likely to limit the downside in share prices. Therefore, it is important to invest in companies with sustainable earnings. Growth in earnings, if any, will be an added bonus as capital preservation may be valued above capital appreciation in uncertain times. In general, high-yielding stocks have lower EPS growth as earnings are being paid out rather than being reinvested to boost future growth.

Companies with a cash hoard like YTL Corp among the large caps and JobStreet among the small caps are in a strong position to acquire deflated assets due to the credit crunch.

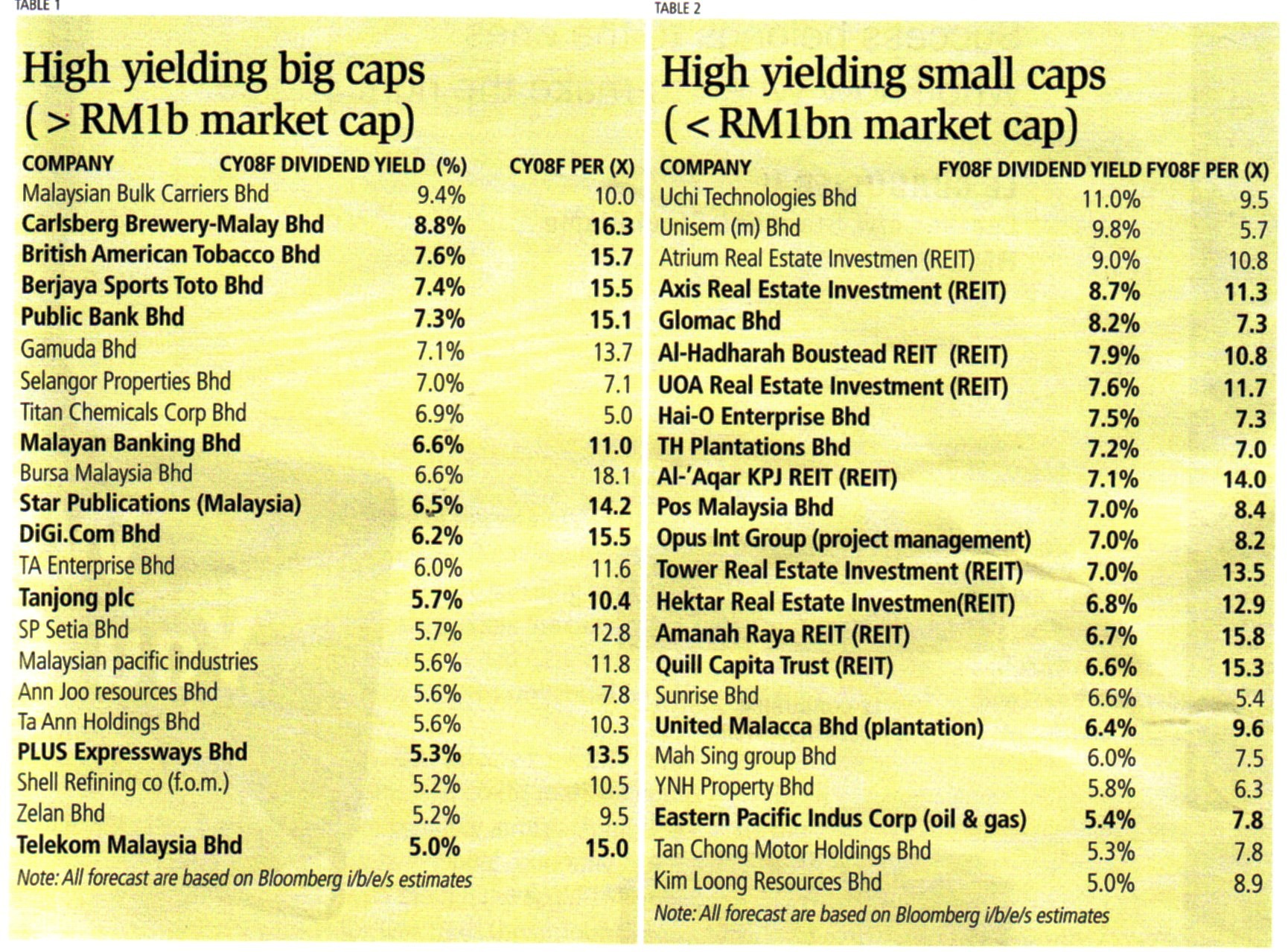

Table 1 shows a selection of big caps with dividend yields above 5%. Those highlighted are in industries with relatively stable earnings like telecommunications, gaming, toll highways, tobacco, beverage and banks. Nevertheless, there are risks to earnings. Sin stocks may be subject to a hike in taxes required to fund the subsidies while banks are exposed to an economic slowdown. In uncertain times, a premium is paid for liquidity. Therefore, large cap stocks are likely to command a premium over small cap stocks.

Table 2 shows a selection of small caps with yields over 5%. Those with relatively stable earnings have been highlighted. They include companies in the plantation, oil and gas and REIT sectors. Despite the recent correction in palm oil prices, strong demand from China and India and the use of vegetable oils for biofuel are likely to sustain palm oil prices. Oil and gas companies are benefiting from high crude oil prices and expenditure on offshore exploration, especially in deep waters.

However, their yields are lower as many are reinvesting for growth. Real estate investment trusts are likely to offer good yields but their scope for share price appreciation is limited as many are slow at expanding through acquisitions.

Global and domestic uncertainties have led to a wait-and-see attitude on stock market investments. Foreign portfolio investors are on the whole reducing their exposure in Malaysia as it is an optional market with only a 3% weighting on the MSCI Asia ex-Japan index. In these uncertain times, selected high-yielding stocks may provide shelter for Malaysian investors looking to be paid while waiting for the political dust to settle.

Choong Khuat Hock is head of stock research and a partner at Kumpulan Sentiasa Cemerlang Sdn Bhd, a fund management company