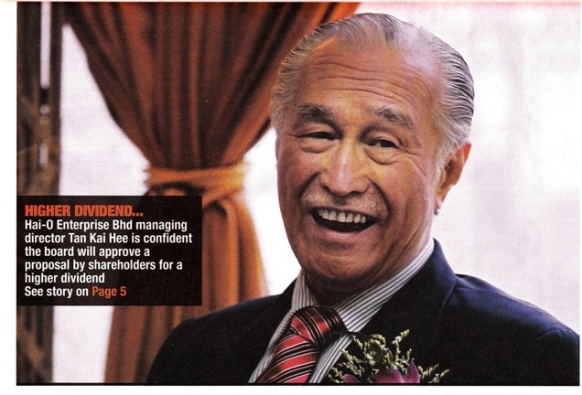

KUALA LUMPUR: Multi-level marketing (MLM) company Hai-O Enterprise Bhd is expected to announce a higher dividend for shareholders today after its board of directors meets to endorse its second quarter (2Q) results.

“I am going to recommend to our board to accept a proposal by our shareholders for a higher dividend. I have confidence the board will approve this proposal,” Hai-O managing director Tan Kai Hee said in an interview with theedgemalaysia.com. The compelling reason for Hai-O to dish out more money to shareholders is that the debt-free company is holding cash of over RM100 million and its earnings outlook is brighter, Tan added.

Since 2007, Hai-O has a dividend policy of paying out 50% of net profit to shareholders. For 1Q of financial year 2013 (FY13), a dividend of seven sen per share was declared.

“This is the right time to reward our loyal shareholders. The dividend in financial year 2013 will definitely be better than last year. But I can’t tell you the quantum,” said Tan, whose family holds about a 25% stake in Hai-O.

Hai-O is expected to release a better set of 2Q results today, compared with 1Q. Tan has confidence that FY13 ending April 30 will net stronger earnings than in FY12.

For 1QFY13 ended July 31, the firm posted a higher net profit of RM10.27 million on a revenue of RM61.14 million, compared with a net profit of RM7.73 million and revenue of RM50.92 million a year ago.

Tan said despite having a net asset value of RM1.24, including cash of 50 sen per share, Hai-O stock has been underperforming. At the current price of about RM2.10, it is trading at a price-earnings ratio (PER) of six to seven times against the sector’s 13 times.

“We feel our earnings potential is high and our share price should fetch a higher PER. Hence, the company continues to buy back its own shares. Although our mandate is 10% of the total shares, we have only bought back 2.5%,” said Tan.

After Hai-O’s 1Q results, OSK Research pegged its target price at RM2.15, while JF Apex Securities and Affin Investment pegged theirs at RM2.34 and RM2.35 respectively.

On the company’s outlook, Tan said as the government is now promoting direct selling and projecting revenue for the sector to rise to RM10 billion this year from RM8.5 billion last year, Hai-O’s MLM division will benefit from this policy.

The government has outlined a plan to facilitate growth in the direct selling industry. The industry is seen to generate RM54.5 billion in revenue under the 10th Malaysia Plan (2011-2015).

Tan said the MLM business, which accounts for 60% of Hai-O’s total revenue, would grow by double digit in FY12 despite the gloomy global outlook.

“In fact, our MLM business did better during the past recessions and global crises. People tried to earn more income via direct selling during bad times. Hence, we expect our MLM business to perform better come 2013,” Tan said.

He noted that most of the products marketed by Hai-O are recession-proof healthcare items that have a long shelf life.

Established in 1975, Hai-O markets Chinese medicated tonic and wines, wellness and healthcare products, and offers clinical services, with its principal business in wholesale.

Hai-O’s revenue and profit took a leap during the 2008-2010 global crisis. It was during those three years that the company won various prestigious awards, including the Forbes Awards. And its share price shot past RM8 at the peak.

But the MLM business took a dip when the government tightened regulatory control over the industry in early 2011. But things are now looking up again.

On Hai-O’s MLM business expansion to Indonesia, Tan said licensing and talent problems had caused Hai-O to slow down its plan. He said: “For now, our focus is on Malaysia.”

On new business ventures, Tan said Hai-O had just set up a new bird’s nest showroom in Kuala Lumpur. The showroom displays various types of bird’s nests and their medicinal value. It is targeting Chinese tourists and China.

“We hope to go big in exporting bird’s nests to China. This will be our growth business in future,” said Tan, founding president of the Malaysia-China Chamber of Commerce.

According to various reports, China consumes the bulk of the world’s bird’s nests. Bird’s nest soup is a 400-year-old Chinese cuisine believed to have the properties of improving complexion and general health.

The global trade in bird’s nests is estimated to be over RM10 billion and exports from Malaysia account for 10%. On property development, Tan said Hai-O has been buying up land and property. Awaiting development is a 28ha plot outside Klang, along the highway to Port Klang. “If there are partners with good property development proposals, we may team up with them,” he said.

On Hai-O’s recent signing of the letter of intent with world-renowned Beijing Tongrentang to set up a joint US$10 million (RM30.6 million) healthcare and wellness centre on a 40:60 basis, Tan said it will provide high-end health check and post-hospitalisation services for Chinese tourists and locals.

Tongrentang, with a history of more than 100 years in China, is a strong brand name in Chinese herbs and medical care.

“The rich China nationals will escape China during freezing winters and hot summers. And if they know Tongrentang has a wellness centre here they are likely to come as medical tourists. Currently, we are looking for a location,” Tan said.

Beijing Tongrentang and Hai-O started their joint venture in Kuala Lumpur in 2002, offering traditional Chinese medicine and medical treatment.

On the succession plan, Tan, in his mid-70s, said “at least 10 candidates” can take over from him anytime as the company is managed by professionals rather than by him alone.