KUALA LUMPUR: Strong earnings growth in Hai-O Enterprise Bhd has helped lift its share price to an all-time high. With its earnings expected to rise further, analysts remain positive about the wellness and multilevel marketing (MLM) group’s growth and stock price.

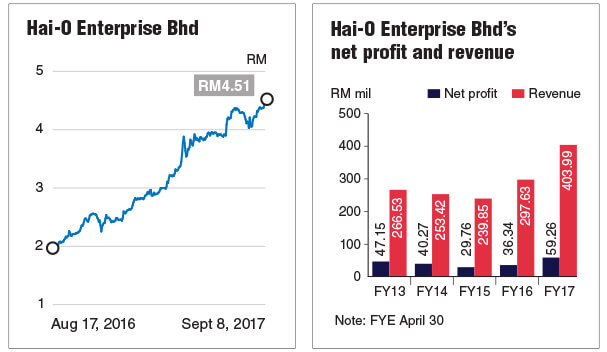

Upon its listing in 1996, the counter generally hovered around the RM1.50 level in subsequent years and only managed to rise to as high as RM2.03 in March 2010. However, in August 2016, the price surged beyond that level and thereafter maintained its upward trajectory, reaching an all-time high of RM4.51 last Friday.

Over the past 12 months, Hai-O’s share price has more than doubled, bringing its market capitalisation to RM1.31 billion.

“Basically, we’re quite positive on consumer stocks. There is an indication that consumption is coming back. There is a sign of recovery,” said a fund manager who declined to be named.

The Malaysian Institute of Economic Research’s Consumer Sentiment Index (CSI) has been rising gradually for the past three quarters from 69.8 points to 80.7. However, it is still below the optimism threshold level of 100 points.

“For Hai-O, it has in the past few quarters showed good development,” the fund manager told The Edge Financial Daily via the phone. “Their strategy to focus on the halal market is a good strategy, compared with other multilevel marketing companies; especially in Malaysia where the majority of the people are bumiputera,”

He said Hai-O also has a resilient growth in terms of distributors as well as membership. And the change in product strategy is showing good growth in earnings.

“We think that there is still strong earnings growth in the quarters to come. We still see some room [to grow],” he said.

The fund manager highlighted that Hai-O’s share price is driven by the strong earnings growth. When asked if now is a good time for investors to buy the stock, he said so long as the earnings are growing, he sees no reason to not invest in Hai-O.

An analyst with a local research house said that compared with its peer Amway (M) Holdings Bhd, Hai-O has more room to grow as the goods from its MLM division are more affordable.

He added that the cost of goods for its MLM division is mainly denominated in ringgit, while Amway’s is in US dollars. Thus, the strengthening ringgit is less likely to impact on Hai-O’s earnings in the MLM division.

However, the analyst is of view that both Hai-O and Amway are “pretty much the same”.

An analyst from TA Securities Sdn Bhd, meanwhile, said consumer sentiment is expected to stay flat for the rest of 2017. However, it is seen to be better in 2018.

Given that the cost of living keeps on increasing, she said it will be a push factor for the people to have MLM as a second job or part-time job.

Moving forward, Hai-O managing director Tan Keng Kang said the group is working on enticing the buzzing young generation to be its distributors and buyers, via the MLM scheme with its consumer products such as food and beverage, fashion, and skin and beauty care products.

Hai-O will be expanding its MLM business by venturing into fashion and beauty care under the brand “Infinence”, supported by the expertise of its non-independent and non-executive director Professor Datuk Dr Choo Yeang Keat, more popularly known as Jimmy Choo, said Tan.

“The reason why we chose all these products (fashion, beauty and skin care) is because it is easy to duplicate from the overseas market as well,” Tan told The Edge Financial Daily. He added that these products are not subject to a lot of rules and regulations as in the case of food supplements.

“Since it is for consumption, the regulations are very strict and it takes a very long time to get the approvals,” he said. Tan also said Hai-O will continuously look for other innovative ways to diversify and will also be constantly launching new products.

Hai-O currently has about 150,000 active distributors and is looking at an additional 5,000 active distributors monthly. Tan also mentioned that the group is exploring overseas markets, in particular Vietnam.

On the impact of the e-commerce business on its MLM business, Tan said it actually complements the group’s existing business. He said that the group has allocated RM10 million for capital expenditure this year to upgrade its warehouse to cater for e-commerce growth.

Currently, e-commerce contributes about 10% of its total revenue.

In addition, Hai-O, which has been registering double-digit growth in both top line and bottom line for the past two financial years, expects the trend to continue for the financial year ending April 30, 2018 (FY18), driven by the MLM division.

For FY17, its net profit rose 63.07% to RM59.26 million from RM36.34 million a year earlier, with revenue up 35.74% to RM403.99 million from RM297.63 million. The net profit margin stood at 14.67% compared with 12.21% in FY16.

While the group’s wholesale and retail divisions experienced marginal declines in sales over the past two financial years, Tan is expecting a reversal in FY18.

“As [the] economy improves and consumer sentiment slightly improves, the GST (goods and services tax) impact is still there. But, having said that, it has become more acceptable. And people dare to spend more these days,” Tan also said.

Tan added that he is optimistic about the group’s overall performance across all divisions in FY18.