KUALA LUMPUR: Hai-O’s name holds the Chinese meaning of seagull, symbolising a determination to pursue where others dare not, and its aspirations to soar far and high. Yet 40 years later, Hai-O Enterprise Bhd finds itself stuck in a trough.

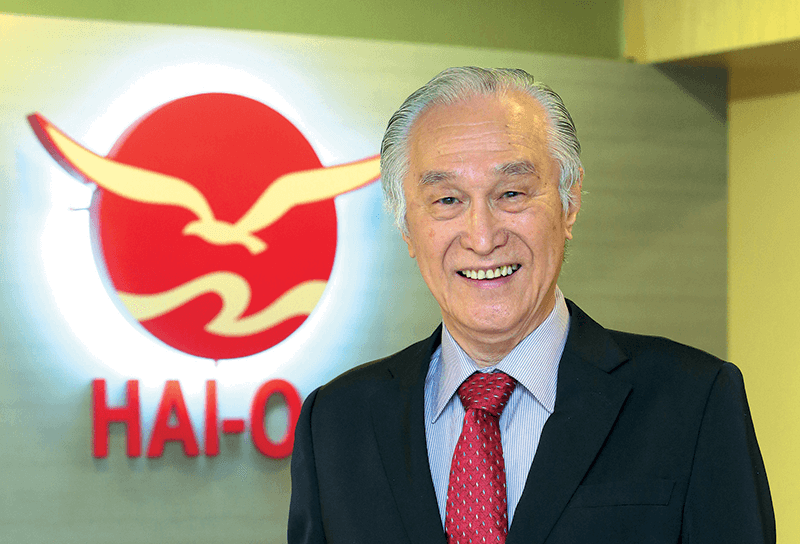

In an interview with The Edge Financial Daily, its founder and group managing director Tan Kai Hee, 78, said during the 40 years that he has led the traditional healthcare company, Hai-O has taken a more conservative and prudent approach to its business undertakings.

Kai Hee believes this was necessary in order to strengthen the company’s fundamentals.

“To be cautious and have a low-risk appetite are part of the company’s policy for the past 40 years in order to deliver sustainable growth, and yet not forget to provide ample returns to our shareholders at the same time,” he said.

However, Kai Hee professed that it is the beginning of the next phase for the RM455.3 million company, whose earnings and revenue have stagnated since its financial year ended April 30, 2013 (FY13). Last Friday saw Kai Hee handing over the reins to his son, Tan Keng Kang, 39, who has been group chief operating officer of the company since May 1, 2014. Kai Hee will stay on as executive chairman.

Under the younger Keng Kang, Hai-O hopes to shed its “conservative” image and will soon embark on several plans that include exploring new projects and strengthening its multilevel marketing (MLM) business in the Asean region.

Kai Hee believes his son can help the company advance to the next level. Aiding the latter is 54-year-old Hew Von Kin, the company’s chief financial officer who has been promoted to executive director.

“The board is now balanced in its composition with members who are highly qualified professionals and those who possess strong business acumen and insight knowledge of our business and industry. Together, their appetite for risk could be set higher than what it is today,” said Kai Hee.

Thus, Kai Hee describes 2016 as a year where Hai-O is set to soar again “towards the next 40 years”.

Despite ongoing economic uncertainty, the company, which had healthy cash balance with short-term investments of RM104.4 million as at April 30, 2015, sees this as an opportune time to acquire assets. However, the company has yet to identify any possible acquisition target.

As at April 30, 2015, Hai-O’s shareholders fund stood at RM253.9 million.

“As Hai-O’s business model is less capital-intensive and over 70% of our business deals are conducted in cash, our cash reserves will continue to accumulate. This is apart from the allocation for capital expenditure (capex) and investment outflow for any potential projects that may arise from time to time,” said Kai Hee.

Hai-O, where the bulk of its revenue contribution comes from the domestic market, is also looking at strengthening its existing markets in Singapore, Brunei and Indonesia, while eyeing expansion to Thailand.

The company will spend about RM5 million to RM10 million in capex for FY16 and FY17, mainly to expand its MLM business through upgrading software system and e-commerce platform, acquiring shops for MLM branches, and setting up regional offices and storage facilities in Johor and Penang to cater for increases in business volume.

Kai Hee sees Asean, particularly Indonesia with its huge population of 200 million, as a potential for growth.

“For Indonesia, some product registrations have been approved while others are in the process for approval. But we are ready anytime to embark on sales and marketing. We have appointed a number of mobile stockists to serve the distributors and customers there,” he said.

Hai-O’s revenues and profits have been declining since FY13, but for the first half ended Oct 31, 2015 (1HFY16), the company registered higher revenue and net profit of RM128.96 million and RM15.38 million compared with RM107.51 million and RM13.39 million, representing an increase of about 20% and 14.8% respectively.

During the results announcement, Hai-O attributed the better performance in 1HFY16 to the introduction of several new “small-ticket” items two years ago, as it strived for a balance between small-ticket and big-ticket items in its MLM business.

“We are confident that the growth momentum will be sustainable for current FY16, and we will strive for sustainable growth beyond FY16,” said Kai Hee, expecting a surge in sales over the Chinese New Year period.

The growth in the company’s revenue and net profit in 1HFY16 was driven by its MLM division, which accounted for 63% of total revenue.

Going forward, the company expects MLM contribution momentum to continue but at a “more significant” pace in tandem with its expansion in Asean, said Kai Hee.

Despite mounting competition in the retail segment, he said Hai-O has no intention of exiting the wholesale and retail businesses, which have been growing by 3-5% per year.

“The wholesale division plays an important role in continuous sourcing of our products, while the retail division remains the pillar of our group in the Chinese medicine market through the presence of over 60 outlets nationwide,” he added.

Its plan is to open two to three outlets per year.

Hai-O’s other initiatives this year include rebranding and upgrading its corporate office at Sun Complex in Jalan Bukit Bintang here, involving a cost of RM3 million to RM5 million.

Kai Hee acknowledged that Hai-O is facing several challenges such as weakened consumer spending due to higher cost of living, a weak ringgit and the impact of the goods and services tax, which has left the company facing a margin squeeze.

The company saw its net margin drop to 12.7% in FY15, from 16.1% in FY14, but Kai Hee expects net margin to stabilise at about 16% this financial year.

“The lower margin in FY15 was mainly due to lower sales achieved by the MLM division and also partly caused by the depreciation of the ringgit against the US dollar,” he said.

To ease the impact of higher import costs due to the weaker ringgit, the company has turned to local substitution for some of its products.

It is also negotiating with its China principals to use yuan instead of the US dollar in trade settlements, as well as kicking off an Employee Entrepreneur Programme to encourage and support its experienced staff to open a retail store of their own by using its retail concept.

Meanwhile, Hai-O will continue its dividend policy of paying at least 50% of net profit to its shareholders and would consider paying out higher dividends depending on its profitability, cash flow requirement and return to shareholders.

It also does not rule out the possibility of rewarding its shareholders with share dividends.

“Distribution by way of share dividends is one of the options that we will consider. In fact we have done it twice in our past records,” said Kai Hee, who holds a 27.79% stake in Hai-O.

As of Jan 29, the company’s treasury shares stood at 8.5 million units, which is equivalent to its issued share capital of 4.19%.

Hai-O shares closed unchanged at RM2.35 last Friday, bringing a market capitalisation of RM455.3 million.

By Tan Siew Mung / The Edge Financial Daily