Traditional Chinese medicine player Hai-O Enterprise was thrust into the limelight by its inclusion in the ‘Forbes Asia 2007 Best List’ recently. We take a look at what’s in store. BY JAMES S

Nine Malaysian companies made it to the ‘Forbes Asia 2007 Best List’ recently for companies with sales under US$ 1 billion (RM3.4 billion). The list of firms comprises 200 companies drawn from over 22,500 listed companies in the Asia-Pacific region. The nine Malaysian companies that made the list were CB Industrial Product Holdings Bhd, Cheetah Holdings Bhd, Coastal Contracts Bhd, Evergreen Fiberboard Bhd, Hai-O Enterprise Bhd, Jobstreet Corporation Bhd, Mah Sing Group Bhd, Padini Holdings Bhd and YNH Property Bhd.

Among these companies, a name which may not sound very familiar is that of Hai-O Enterprise, as it is not widely covered by analyst. RHB Research Institute, however, recently initiated coverage on the stock, and it is expected that the company is likely to attract more attention soon, given its inclusion in the Forbeslist. Is the stock a refreshing investment idea? We look deeper into the company.

A traditional Chinese medicine retailer

Unknown to many outside its business, Hai-O has actually been a household name in the traditional Chinese medicine market since 1975. The company is principally involved in the wholesale and retail trade of traditional Chinese medicine (TCM) such as medicated wine (mostly made from Chinese herbs), tea (with the famous one being the Pu-er), health tonics and other healthcare products. It is also involved in the multi-level marketing (MLM) business for products such as beauty and wellness, food nutrition, household, car care and accessories, and water treatment systems.

TCM’s products are more famous among the Chinese community, while the company’s MLM products are better known to the Malay community, with 90% of its MLM distributors being ethnic Malays. Currently, Hai-O supplies TCM and MLM products to its 56 retail outlets, 3,000 retail medical halls and over 60,000 MLM distributors.

Traditional Chinese medicine

According to the investment report from RHB Research Institute, the wholesale and retail TCM market is highly fragmented in Malaysia. Generally, the industry is dominated by two large players – Hai-O and Eu Yan Sang – while there are also about 3,000 smaller players, ie, the traditional medical halls.

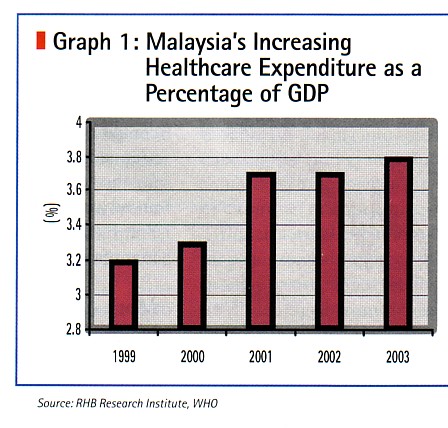

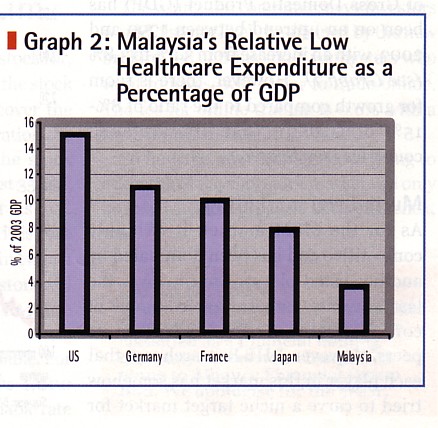

The size of the TCM market is estimated at about RM2 billion a year and growing, due mainly to the rising awareness of health and affluence. According to the World Health Organisation (WHO), Malaysia’s healthcare expenditure as a percentage of Gross Domestic Product (GDP) has been on an updated between 1999 and 2003, with an increase from 3.2% to 3.8%. However, there is room for growth compared to the ratio of 8%-15% of GDP in that of developed countries.

Multi-level marketing

As for the MLM market, it is highly competitive and has been dominated by another listed player, Amway, over the last few years, with its sizable number of core distributors that outnumber its peer. However, RHB Research says that each player in this market has somehow tried to carve a niche target market for itself to avoid direct competition. Hence, launches of new products and product quality have become the crucial elements in drawing in new members into the distribution force as well as retaining the existing distributors.

A scalable business model

In its report, RHB Research points out that Hai-O’s wholesale and retail division and its MLM division are highly complementary to each other. The former generates consistent income while the latter provides the earnings growth. In addition, Hai-O’s cash-generating retail division also provides the short-term funds needed to meet the group’s yearly operating expenses. As such, the company’s business model is actually highly expandable, says the research house.

Hai-O’s core competence in the TCM segment is proven by the fact that the company has exclusive distribution rights from its suppliers in China to market over 200 brands of renowned Chinese medicine and healthcare products in the country.

The TCM wholesale and retail segments are the backbone of Hai-O. These segments have been registering stable revenue growth at a three-year CAGR (compounded annual growth rate) of 3%. The operating margin for these segments has also risen to 14.1% in financial year (FY) 2007 from 5.6% in FY04 due mainly to higher contributions from the Pu-er tea, a higher yielding product.

Going forward, RHB Research expects the revenue contribution from these segments to grow at 6% p.a. in the next two financial years on the back of four new retail outlets and also the rising demand for Pu-er tea. The rising demand is attributed to the tea’s medicinal value, as researchers have found that the consumption of Pu-er tea regularly reduces cholesterol and has anti-oxidant properties.

Meanwhile, in the last three years, the revenue of Hai-O’s MLM segments has grown by a CAGR of about 40% p.a. underpinned by the increase in the number of its core distributors by an average of 10,000 p.a. to the current 60,000 members. Out of this pool of members, 90% is from the Malay ethnic group. In view of its more generous MLM payout scheme of 65% as compared to the market average of 50%-60%, the number of new distributors is expected to continue to grow by 1,000/month for the next two years, says RHB Research.

High barrier of entry

Despite the huge market potential, RHB Research reckons that the barrier of entry is surprisingly high for any new competitor due to the long operating track record of Hai-O with its suppliers. For instance, the strategic tie-up of Hai-O and Peking Tong Ren Tang, a listed company in Hong Kong and Shanghai, is seen as strong competitive advantage for the company. The tie-up gave Hai-O an advantage over its peers such as Eu Yan Sang, whose products are mainly manufactured in Malaysia.

More new ventures?

In April 2007, Hai-O entered into a Memorandum of Understanding (MoU) with Golden Hope Plantations Bhd to register and distribute Golden Hope’s ‘TriE’, a form of vitamin E capsule, in China. This product is still pending the necessary approval from the Ministry of Health of China.

While the earnings potential is hard to estimate at this moment, analysts believe that the prospect of this tie-up should be bright should the Chinese authorities give the green light, given that the initial capital outlay is minimal and the operating cost low since it could tap into Hai-O’s existing supplier’s distribution channels.

Boost from higher disposable income, strengthening ringgit

OSK Investment Research, meanwhile, in its take on the company believes that the recent salary revision for civil servants will have a significant effect on Hai-O’s earnings from the anticipated increase in overall consumer spending power. This expectation is basically backed by the fact that the Bumiputera segment comprises 90% of the company’s MLM division.

The research house also reckons that Hai-O could potentially benefit from the strengthening of the ringgit against the dollar. This is because imports account for 60% of the company’s total purchase. As such, any appreciation in the ringgit would definitely boost Hai-O’s gross profit margin. Based on its estimate, for every 1% appreciation in the ringgit, Hai-O’s gross profit margin will get a boost of 0.3%-0.4%.

Main board beckons

Apart from a solid business operation, RHB Research believes that the migration of Hai-O from the second board to the main board of the local bourse, expected to be completed soon, should raise the profile of the stock and attract more investor attention and buying interest.

Hai-O has also recently announced a one-for-five bonus issue that will increase the liquidity of its shares on the exchange. Another piece of good news for shareholders could be the formalising of the group’s dividend policy to a payout of at least 50% of its net profit by managemnet, says RHB Research.

Based on the consensus FY08 EPS (earnings per share) forecast of 29 sen for the group, Hai-O should pay at least a 14.5 sen GDPS (gross dividend per share), which translates into a strong gross dividend yield of 5.5%.

Conclusion

Hai-O appears set to expand further in terms of its business and upside potential, given its scalability, leading market position and promising earnings outlook. As such, it’s not surprising that several research houses such as RHB Research and OSK Research have been asking their clients to buy the stock to an average target price of RM3.35/share.

However, the company may need to put itself more in the limelight, as the investment fraternity is largely unfamiliar with its business at present. The group’s recent inclusion into the Forbes list may have just given the company the much-needed push it needs in this area. Chinese medicine play, anyone?