By Ng Kar Yean

The two parties make strange bedfellows. Yet the coming together of Chinese-centric Hai-O Enterprise Bhd and bumiputera entrepreneurs has brought financial success to both parties.

Before Hai-O started to target the Malay market using the multi-level-marketing (MLM) structure some five years ago, most consumers of its medicine and healthcare products were Chinese.

Revenue contribution from the MLM division was minimal then. However, in the financial year (FY) ended April 30, 2007, some 53% of the group's RM189.3 million revenue came from the division.

Hai-O group managing director Tan Kai Hee is clearly pleased with the group's achievement.

“Growth in the direct sales division has been driving the group's sales. Hai-O has been able to successfully nurture a group of 'usahawan' bumiputera,” Tan tells The Edge.

In August 2007, the Ministry of Entrepreneur Development and Cooperative Development gave the company an award for promoting and developing business partnership between bumiputera and non-bumiputera companies.

From a zero base five years ago, the group has 60,000 MLM members now, of whom 95% are Malays, says Tan. Hai-O attracts over 1,000 new recruits every month. The high growth rate is a testament to the attractiveness of Hai-O's MLM business proposal to entrepreneurs.

Hai-O has made great efforts to ensure that its Malay MLM members are well supported with high quality and safe products, an extensive product distribution network and rewarding incentives, says Tan.

“We speak their language, understand their culture and choose products that suit their needs,” he adds.

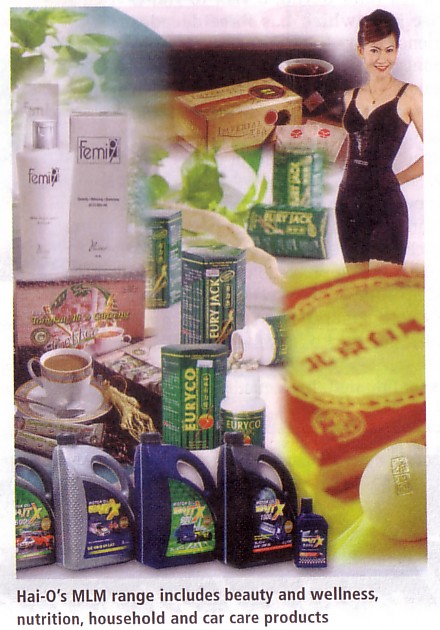

Hai-O's MLM range includes beauty and wellness, nutrition, household and car care products and water treatment systems.

Most of the MLM members get a share of between 40% and 50% of their sales. This means that out of every RM1,000 sales, about RM400 and RM500 goes to the pockets of MLM members. The highest payout ratio a member can achieve is up to 64% of sales.

This make Hai-O's MLM division attractive , as other MLM companies offer a lower payout of about 50% to 60%.

The higher achiever is a husband and wife team that collectively earns a salary of about RM3 million in a year, says Tan.

“Other MLM companies may resort to cutting their members' incentives when they earn too much. We don't do that because we want to treat our members fairly. We want both parties to benefit from the business.”

Another surprising fact is there are more female than male members. The former consistently bring in more sales. Tan attributes their success to diligence and affinity for friends and relatives. Not surprisingly, its best selling product is lingerie, which made up 60% of the MLM's revenue in FY2007.

What is the impact of Hai-O's success in MLM business on its bottom line?

Over the last three financial years, the group's revenue grew at a compounded annual growth rate of 40%. from RM119.5 million in FY2004, its revenue grew to RM189.3 million in FY2007. More importantly, its profit before tax (PBT) margin improved over two times from 5.3% to 16.2% during the period. This helped the group's profit to grow at much faster rate. Its net profit grew over five times from RM3.9 million in Fy2004 to RM21.4 million in FY2007.

Besides its high growth, the stock also gives decent dividends. In FY2007, it offered a dividend yield of 4.2%. With earnings per share of 26.40 sen and share price of about RM2.60, the stock is trading at historical price-to-earning ratio of about 10 times.

Hai-O plans to open more outlets in high traffic areas

The group has a healthy balance sheet. It has net cash of about RM20 million. In FY2007, its operations generated cash of RM28 million.

Hai-O has committed to distributing at least 50% of its net profit as dividend. RHB Research expects the group to achieve an EPS of 28.60 sen in FY2008 and to pay a net dividend of 11.6 sen. This translates into a net dividend yield of 4.4%, based on its current share price of about RM2.60.

On its retail division, which made up 19% of its revenue in FY2007, Tan says there are plans to phase out the franchised outlets. There are 16 such outlets now. The group owns the other 40.

Tan says the move is aimed at gaining better control of Hai-O retail outlets. Currently, some franchised outlets sell products that are not sourced by Hai-O. This could tarnish the group's image if such products are harmful to the public, he adds.

To replace the franchised outlets, Hai-O plans to open more outlets in high traffic areas.

Tea fund, anyone?

Fund management company Kumpulan Sentiasa Cemerlang Sdn Bhd (KSC) will be launching possibly the first fund that seeks returns from investments in Pu-Er tea.

What makes Pu-Er tea a potential investment is that it is the only tea that tastes better as it ages. There are already funds that invest in wine, which has the same “taste better with age” characteristics.

“Pu-Er tea is the only Chinese tea that does not have an expiry date. Its value increases over time,” says a Chinese tea connoisseur. It is liked for its smooth and almost sweet taste, he adds.

So valuable is Pu-Er tea that in certain ancient dynasties, it was an acceptable form of currency.

KSC head of stock research Choong Khuat Hocks says the company stumbled upon the idea of a tea fund during a visit to Hai-O Enterprise Bhd, which has three decades of experience in traditional Chinese healthcare products.

“Investors can diversify their investment portfolio with the tea fund. It can provide investors with returns (from other types of funds) apart from investment in equity and property,” he says.

By his own admission, Choong's appreciation of Chinese tea is not the same level as true connoisseurs.

Regardless, his appreciation for Pu-Er tea as a good investment grew as he learn about its supply and demand situation, and more importantly, how much its value appreciates over time.

Princes for branded, high quality Pu-Er tea can appreciate up to 50% per annum, he says. For example, 350gm of Pu-Er tea produced in 1985 had a value of RM350. Four years later, the market price increased to over RM2,000. This translates into a return of about 470% over a five-year period.

“Pu-Er tea collecting and drinking is regarded as a status symbol among many Chinese, As the Chinese become more affluent, I expect demand for the tea to rise,” says Choong.

The Securities Commission (SC) approved the launch of KSC Alternative Investment Fund in August. The fund will invest in companies that deal in Pu-Er tea. It is a closed-end fund with a three-year tenure and an approved fund size of RM50 million. The minimum investment into the fund is RM100,000.

“We target to achieve a return of at least 50% in three years,” says Choong.

KSC is only looking for 50 investors for the fund, and hopes to raise about RM20 million from high net worth individuals, he adds.

Unlike the stock market where the mechanism is in place to give institutional and retail investors fair access to shares of listed companies, buying and selling of Pu-Er tea is still the domain of specialists.

Hence, KSC needs the assistance of Pu-Er tea specialists. It is teaming up with Hai-O, which will be in charge of sourcing high-quality Pu-Er tea. Hai-O will also look for buyers when the time is right to re-sell the product. The company will also store the product for KSC.

Hai-O director Tan Keng Kang is the company's Pu-Er specialist. He says Hai-O has invested over RM10 million in about 200 tonnes of the tea in the past eight years. Tan estimates the current value of its tea stock has more than doubled.

Pu-Er tea is grown mainly in China's Yunnan province, where the sub-tropical climate, high altitude and soil condition provide a conducive environment for good growth.

According to the China Council for the Promotion of International Trade, Yunnan, the consumption of Pu-Er tea increased from less than 5,000 tonnes per annum in 2002 to over 25,000 tonnes last year. However, during the same period, the land size for the tea lagged behind the growth rate of consumption. This suggests demand for high quality Pu-Er tea will continue to outstrip supply in the coming years.

KSC's Pu-Er tea fund will be launched this Saturday. Of course, Pu-Er tea will be served.